The European market offers a large patient base, strong scientific talent pools and increasingly innovation‑friendly policies.

But it also presents complexity.

There are 27 EU member states, 30 if you include the EEA, multiple regulatory regimes, diverging pharma reimbursement systems and a fragmented drug commercialisation landscape.

In this blog, we explore building a commercial presence, timelines and market‑prioritisation in the EU — giving you actionable considerations to build a viable and realistically timed EU pharma strategy.

Why Europe matters — and what makes it different

Europe remains the second-largest regional pharmaceutical market (after North America), accounting for about 23% of global sales. At the same time, key policy initiatives by the European Commission (EC) aim to increase the EU’s attractiveness for life-sciences innovation via funding, hubs and streamlined regulation.

However, the EU remains fragmented — regulatory approvals via the European Medicines Agency (EMA) are harmonised, yet national reimbursement, pricing, health technology assessment (HTA) and access pathways differ country by country. As such, commercial launch and country-by-country rollout often require two to three years of planning for first product launches.

This is why it is crucial to tailor your EU pharma strategy by mapping legal responsibilities, timelines and prioritised markets.

1. Setting up your EU legal/entity presence

What do we mean by ‘setting up an EU legal/entity presence’?

For market authorisation and commercial operations, you commonly have three broad routes:

- Establish a local EU/UK subsidiary or branch (your own legal entity) and operate directly.

- Appoint a local distributor or partner to handle local regulatory/commercial responsibilities.

- Appoint a specialised pharma services company to provide end-to-end commercialisation support — including, where appropriate, acting as the marketing authorisation holder (MAH) on your behalf.

Why does this matter for your EU pharma strategy?

Establishing your own legal entity in Europe carries significant regulatory, operational and cost implications. As MAH, you must demonstrate and maintain systems for product quality, pharmacovigilance (PV), release-to-market, regulatory compliance, qualified persons where required and more.

The entity must also handle country-specific labelling/language requirements, import/export logistics, contractual and insurance requirements, tax and employment law obligations and local commercial representation.

All of this takes time, budget and senior operational resources to do correctly.

Common challenges when setting up an EU/UK entity

- Regulatory obligations and ongoing liabilities. The MAH is legally accountable for product safety, PV reporting, the quality management system (QMS) and compliance with EMA and national rules. Failing to meet these obligations creates both regulatory and reputational risk.

- Pharmacovigilance infrastructure. You need a qualified person for pharmacovigilance (QPPV), PV systems, signal detection and reporting workflows, and continuous safety management.

- Quality and supply continuity. The MAH must ensure good manufacturing practices (GMP), batch release arrangements and QMS oversight — even when manufacturing is outsourced.

- Commercial and legal setup. Local contracts, distribution agreements, insurance, employment, VAT registration and corporate governance add complexity and cost.

- Time and capital. Entity formation, recruitment and systems implementation typically add months (and meaningful cost) before revenue can be generated.

A specialist pharma services company with flexible, comprehensive drug commercialisation solutions can help mitigate these challenges by assuming MAH responsibilities (either temporarily or long-term) and taking on legal and operational obligations, such as PV, QMS, audits and regulatory liaison.

By outsourcing MAH responsibilities and other commercial functions, you can compress the path to first launch while you evaluate whether establishing your own entity is the right long-term move. As such, you should treat the choice of entity model (own subsidiary, distributor or services partner/MAH) as a fundamental part of your pharma market access strategy.

2. Timeline mapping for EU market entry and launch

Why does a clear pharma market access timeline matter?

Underestimating the time to enter the EU market is a common pitfall. Many companies focus on a US launch, delay EU planning and then face delays and sub-optimal launches. But if you want a successful rollout, you need to make your EU pharma strategy a priority.

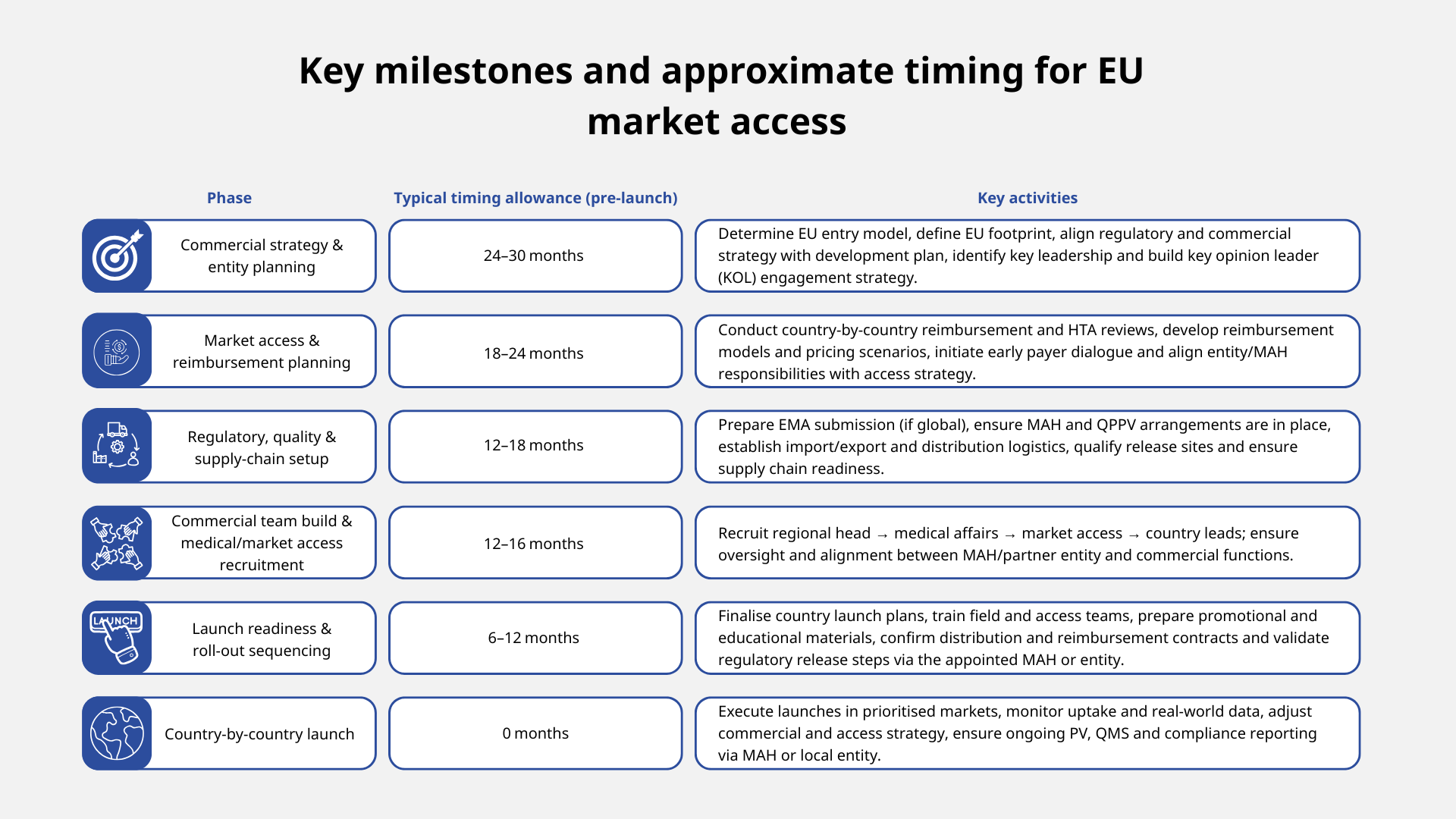

Some companies try to compress this timeline; however, doing so often leads to ‘soft’ launches, low uptake or missed market access opportunities.

A realistic entry timeline gives you sufficient build‑up of KOL/payer engagement, lean commercial infrastructure, country‑specific pharma market access strategy and contingency for regulatory delays.

4 tips to optimise your pharma market access timeline

- Start planning your EU pharma strategy early — ideally concurrently with late drug development.

- Use a clear entity plan or trusted pharma services partner to anchor team, infrastructure and drug commercialisation operations.

- Build a ‘phase‑gate’ timeline with target countries ranked by access potential and commercial attractiveness.

- Monitor upcoming EU policy/regulatory reforms (e.g. upcoming pharma legislation) that could alter timelines or incentives.

3. Market prioritisation — choosing which EU countries and when

Criteria for prioritising drug commercialisation markets

When selecting launch markets, you should evaluate each country on a set of criteria:

- Market size and growth potential

- Regulatory and reimbursement speed

- Clinical trial infrastructure and patient availability

- Commercial infrastructure readiness — including ease of marketing authorisation, distribution and local partnerships.

- Cost to commercialise and complexity of access — smaller markets may cost less to launch but offer lower revenue; large markets may cost more but yield higher payoff.

- Competitive and pricing environment

- Alignment with value proposition/indication — some indications (rare diseases, advanced therapies) may have accelerated pathways or favourable access in certain countries.

Typical country prioritisation sequence

For many small to mid-sized biotech and pharma companies, a common approach is:

- Anchor country (major market), e.g. Germany, France, the Netherlands, Belgium.

- Early‑adopter markets where access and uptake are quicker: Nordic countries, Benelux, Austria/Switzerland (if applicable).

- Broader EU rollout: Spain, Italy, Portugal and smaller markets in Eastern Europe, where growth is faster, but access may lag.

- Low‑priority markets: smaller markets, high complexity, lower ROI until you have traction.

Special considerations for advanced therapies

- For advanced therapeutic modalities (e.g. cell/gene therapies), look for countries with established advanced‑therapy manufacturing/HTA pathways and centres of excellence.

- Some countries may offer accelerated or conditional pharma reimbursement for high‑unmet‑need products — target those early.

- Given complexity and cost, a selective launch in fewer markets initially may make more sense than a broad, distributed rollout.

4. Integrating entity choice, timeline and market prioritisation into one EU pharma strategy

The ‘three-lens’ strategic framework

- Entity Lens — will you establish your own EU/UK entity, appoint a distributor or engage a pharma services partner who can act as MAH? How will this choice underpin regulatory, commercial, manufacturing and logistics operations?

- Timeline Lens — when will you launch? Back‑map all key commercial, regulatory and supply‑chain milestones from the target launch date.

- Market Prioritisation Lens — which countries, when? Rank markets by attractiveness, readiness and fit to your indication, then sequence rollout accordingly.

By overlaying these three lenses, you create a clear roadmap for your pharma market access strategy.

Common drug commercialisation pitfalls

- Under‑estimating timeline: treating Europe as ‘fast‑follow’ to the US leads to missed market windows.

- Ignoring market fragmentation: assuming ‘EU = Europe’ oversimplifies the 27+ distinct markets with unique access/regulation.

- Poor prioritisation: launching in many countries simultaneously without focus may dilute resources and reduce impact.

- Insufficient access planning: market access needs early engagement; waiting until dossier filing is too late.

- Lack of local infrastructure: selecting markets without local commercial/regulatory capabilities slows uptake.

- Ignoring regulatory change: EU pharma legislation reform, biotech hubs and manufacturing incentives are evolving — ignoring them is risky.

How to mitigate these challenges

- Decide your entity model early (own entity, distributor or pharma services partner/MAH) and embed that choice in your EU pharma strategy from the outset.

- Build a detailed timeline‑roadmap with slack for uncertainties.

- Conduct a thorough market-by-market assessment and prioritise logically.

- Engage local market‑access and pharma reimbursement experts early.

- Use established pharma services providers or partners with proven infrastructure and skills to fill capability gaps while you scale.

- Monitor macro‑trends and regulatory reforms in EU life sciences (e.g. biotech manufacturing incentives).

TMC Commercial provides flexible, full-service drug commercialisation solutions, giving you the opportunity to build your own commercial presence in the EU without needing to out-license to a partner. If your infrastructure is limited, we also have the specialist expertise to act as your MAH, whether as a temporary bridge or a long-term solution.

Contact our team today at connect@tmcpharma.com to learn more about our pharma services and how we can help you gain marketing authorisation in the EU efficiently and cost-effectively.